Sales Tax In Omaha Ne 68117 . Omaha, ne sales tax rate. There is no applicable county tax or special tax. Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. The december 2020 total local sales. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. Current local sales and use tax rates and other sales and use tax information The current sales tax rate in omaha, ne is 7%. The combined rate used in this calculator (7%) is the result of the nebraska. Nebraska jurisdictions with local sales and use tax. The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the local sales. The 68117, omaha, nebraska, general sales tax rate is 7%. The current total local sales tax rate in omaha, ne is 7.000%. Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from.

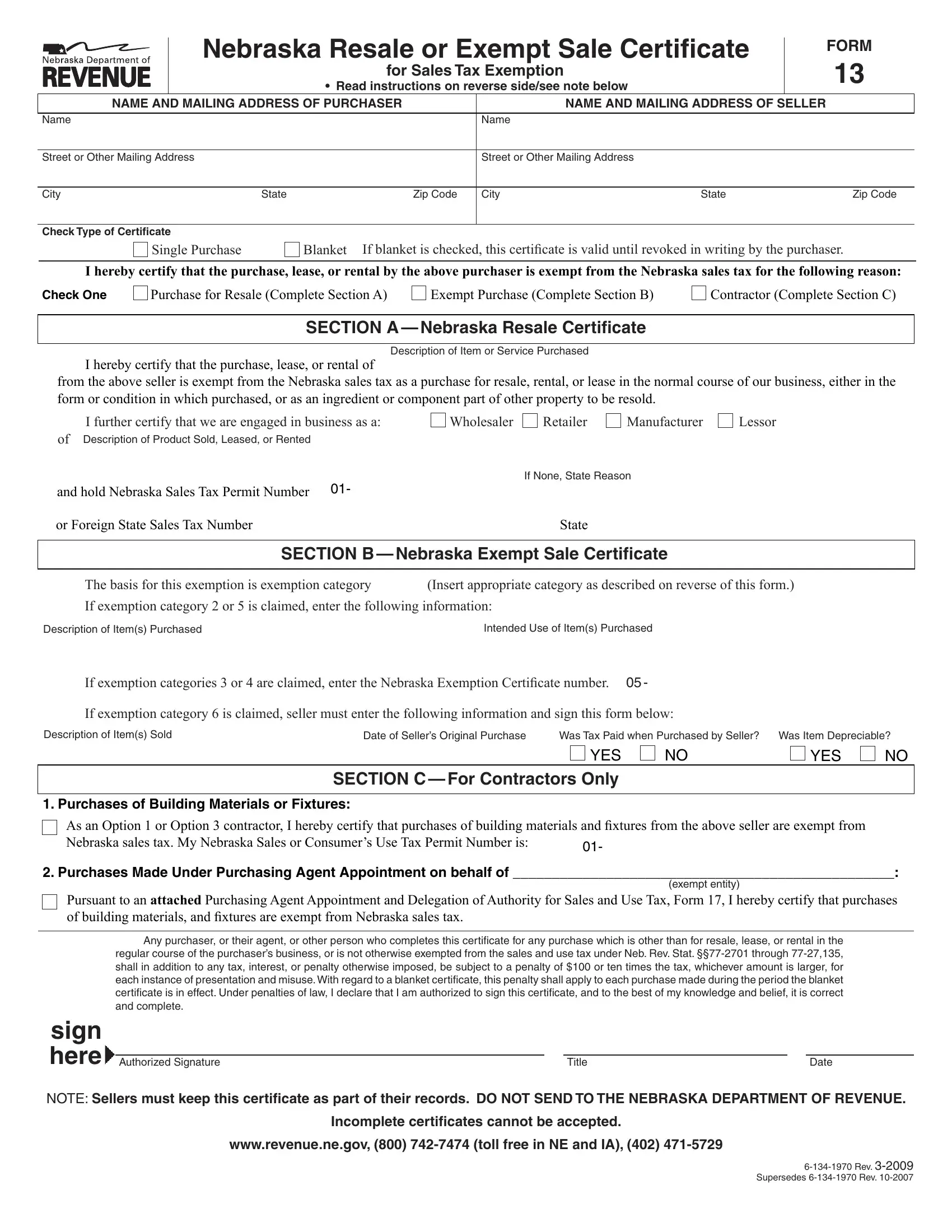

from formspal.com

The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the local sales. The combined rate used in this calculator (7%) is the result of the nebraska. Omaha, ne sales tax rate. Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. The current sales tax rate in omaha, ne is 7%. The december 2020 total local sales. There is no applicable county tax or special tax. The current total local sales tax rate in omaha, ne is 7.000%. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. Current local sales and use tax rates and other sales and use tax information

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online

Sales Tax In Omaha Ne 68117 The current sales tax rate in omaha, ne is 7%. The combined rate used in this calculator (7%) is the result of the nebraska. The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the local sales. Omaha, ne sales tax rate. Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from. Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. The 68117, omaha, nebraska, general sales tax rate is 7%. Nebraska jurisdictions with local sales and use tax. The current sales tax rate in omaha, ne is 7%. Current local sales and use tax rates and other sales and use tax information The current total local sales tax rate in omaha, ne is 7.000%. There is no applicable county tax or special tax. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. The december 2020 total local sales.

From legaltemplates.net

Free Nebraska Motor Vehicle Bill of Sale Form Legal Templates Sales Tax In Omaha Ne 68117 Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from. The combined rate used in this calculator (7%) is the result of the nebraska. Current local sales and use tax rates and other sales and use tax information The current sales. Sales Tax In Omaha Ne 68117.

From www.heartlandproperties.com

4309 S 62nd Street, Omaha, NE, 68117 MLS ID22327156 Single Family Sales Tax In Omaha Ne 68117 Nebraska jurisdictions with local sales and use tax. The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the local sales. The current sales tax rate in omaha, ne is 7%. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. Current local. Sales Tax In Omaha Ne 68117.

From questautosales.com

Used 2017 Audi A6 for Sale in Omaha NE 68117 Quest Auto Sales Sales Tax In Omaha Ne 68117 Current local sales and use tax rates and other sales and use tax information The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the local sales. Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from. There is no applicable county tax or special tax.. Sales Tax In Omaha Ne 68117.

From www.formsbank.com

Form 10 Nebraska And Local Sales And Use Tax Return printable pdf Sales Tax In Omaha Ne 68117 Nebraska jurisdictions with local sales and use tax. The 68117, omaha, nebraska, general sales tax rate is 7%. The combined rate used in this calculator (7%) is the result of the nebraska. Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from. The december 2020 total local sales. The current sales tax rate in omaha,. Sales Tax In Omaha Ne 68117.

From associatedtaxomaha.com

Associated Tax Just another WordPress site Sales Tax In Omaha Ne 68117 The current total local sales tax rate in omaha, ne is 7.000%. There is no applicable county tax or special tax. Nebraska jurisdictions with local sales and use tax. Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. Omaha, ne sales tax rate. Click for sales tax rates, omaha sales tax calculator, and printable sales. Sales Tax In Omaha Ne 68117.

From www.crexi.com

5303 F St, Omaha, NE 68117 Sales Tax In Omaha Ne 68117 Omaha, ne sales tax rate. Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from. The current sales tax rate in omaha, ne is 7%. Nebraska jurisdictions with local sales and use tax. The current total local sales tax rate in omaha, ne is 7.000%. Look up 2024 sales tax rates for the 68117 zip. Sales Tax In Omaha Ne 68117.

From www.crexi.com

5048 L St Omaha NE 68117, Omaha, NE 68117 Sales Tax In Omaha Ne 68117 Omaha, ne sales tax rate. The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the local sales. The current sales tax rate in omaha, ne is 7%. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. The december 2020 total local. Sales Tax In Omaha Ne 68117.

From www.crexi.com

6701 L St, Omaha, NE 68117 Sales Tax In Omaha Ne 68117 The current total local sales tax rate in omaha, ne is 7.000%. The 68117, omaha, nebraska, general sales tax rate is 7%. There is no applicable county tax or special tax. The combined rate used in this calculator (7%) is the result of the nebraska. Nebraska jurisdictions with local sales and use tax. Omaha, ne sales tax rate. Current local. Sales Tax In Omaha Ne 68117.

From omaha-ne.americanlisted.com

Used 2017 Chevrolet Traverse AWD Premier OMAHA, NE 68117 for Sale in Sales Tax In Omaha Ne 68117 Current local sales and use tax rates and other sales and use tax information The december 2020 total local sales. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from. The combined rate used in this calculator. Sales Tax In Omaha Ne 68117.

From www.crexi.com

5050 L St, Omaha, NE 68117 Sales Tax In Omaha Ne 68117 There is no applicable county tax or special tax. The current sales tax rate in omaha, ne is 7%. The 68117, omaha, nebraska, general sales tax rate is 7%. Nebraska jurisdictions with local sales and use tax. Omaha, ne sales tax rate. The current total local sales tax rate in omaha, ne is 7.000%. Look up 2024 sales tax rates. Sales Tax In Omaha Ne 68117.

From questautosales.com

Used 2016 MercedesBenz CClass 4dr Sdn C 300 Luxury 4MATIC for Sale in Sales Tax In Omaha Ne 68117 The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. The december 2020 total local sales. The 68117, omaha, nebraska, general sales tax rate is 7%. There is no applicable county tax or special tax. Nebraska jurisdictions with local sales and use tax. The combined rate used in this calculator (7%) is. Sales Tax In Omaha Ne 68117.

From www.crexi.com

6503 L Street, Omaha, NE 68117 Sales Tax In Omaha Ne 68117 There is no applicable county tax or special tax. The current total local sales tax rate in omaha, ne is 7.000%. Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. Omaha, ne sales tax rate. The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the. Sales Tax In Omaha Ne 68117.

From www.crexi.com

4910 F St, Omaha, NE 68117 Sales Tax In Omaha Ne 68117 Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from. The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the local sales. There is no applicable county tax or special tax.. Sales Tax In Omaha Ne 68117.

From www.formsbank.com

Form 10 Nebraska And Local Sales And Use Tax Return Example printable Sales Tax In Omaha Ne 68117 The combined rate used in this calculator (7%) is the result of the nebraska. Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. The 68117, omaha, nebraska, general sales tax rate is 7%. There is no. Sales Tax In Omaha Ne 68117.

From themumpreneurshow.com

How To Pay Sales Tax For Online Business? The Mumpreneur Show Sales Tax In Omaha Ne 68117 The current total local sales tax rate in omaha, ne is 7.000%. Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. The combined rate used in this calculator (7%) is the result of the nebraska. Nebraska jurisdictions with local sales and use tax. The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state. Sales Tax In Omaha Ne 68117.

From www.formsbank.com

Notice To Nebraska And Local Sales And Use Tax Permitholders printable Sales Tax In Omaha Ne 68117 Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from. Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. The 68117, omaha, nebraska, general sales tax rate is 7%. Omaha, ne sales tax rate. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5%. Sales Tax In Omaha Ne 68117.

From evausacollection.com

Bespoke Sales and use tax certificate.png Eva USA Sales Tax In Omaha Ne 68117 The 68117, omaha, nebraska, general sales tax rate is 7%. Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. Click for sales tax rates, omaha sales tax calculator, and printable sales tax table from. The omaha, nebraska sales tax is 7.00%, consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the local. Sales Tax In Omaha Ne 68117.

From www.salestaxhelper.com

Nebraska Sales Tax Guide for Businesses Sales Tax In Omaha Ne 68117 The combined rate used in this calculator (7%) is the result of the nebraska. Look up 2024 sales tax rates for the 68117 zip code and surrounding areas. The current total local sales tax rate in omaha, ne is 7.000%. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. Nebraska jurisdictions. Sales Tax In Omaha Ne 68117.